Recasting the Future of Financial Advice

Empowering advisors from all disciplines with an industry leading

personal asset liability management platform.

"Bonsai was created with the vision where financial advice and guidance are anchored in the methodology of personal asset liability management (PALM). The foundation of this vision is based on managing the entirety of a client's financial structure with the same level of dedication and diligence that it takes to bonsai a tree. In doing so, we believe advisors will become indispensable to their clients."

– Robert DeChellis, Bonsai Founder & CEO

The Complexity of Uncertainty

Attempting to plan for the future without taking into account the full complexity of a client's financial structure is destined to end up with uncertain outcomes.

Seeing the Whole Picture

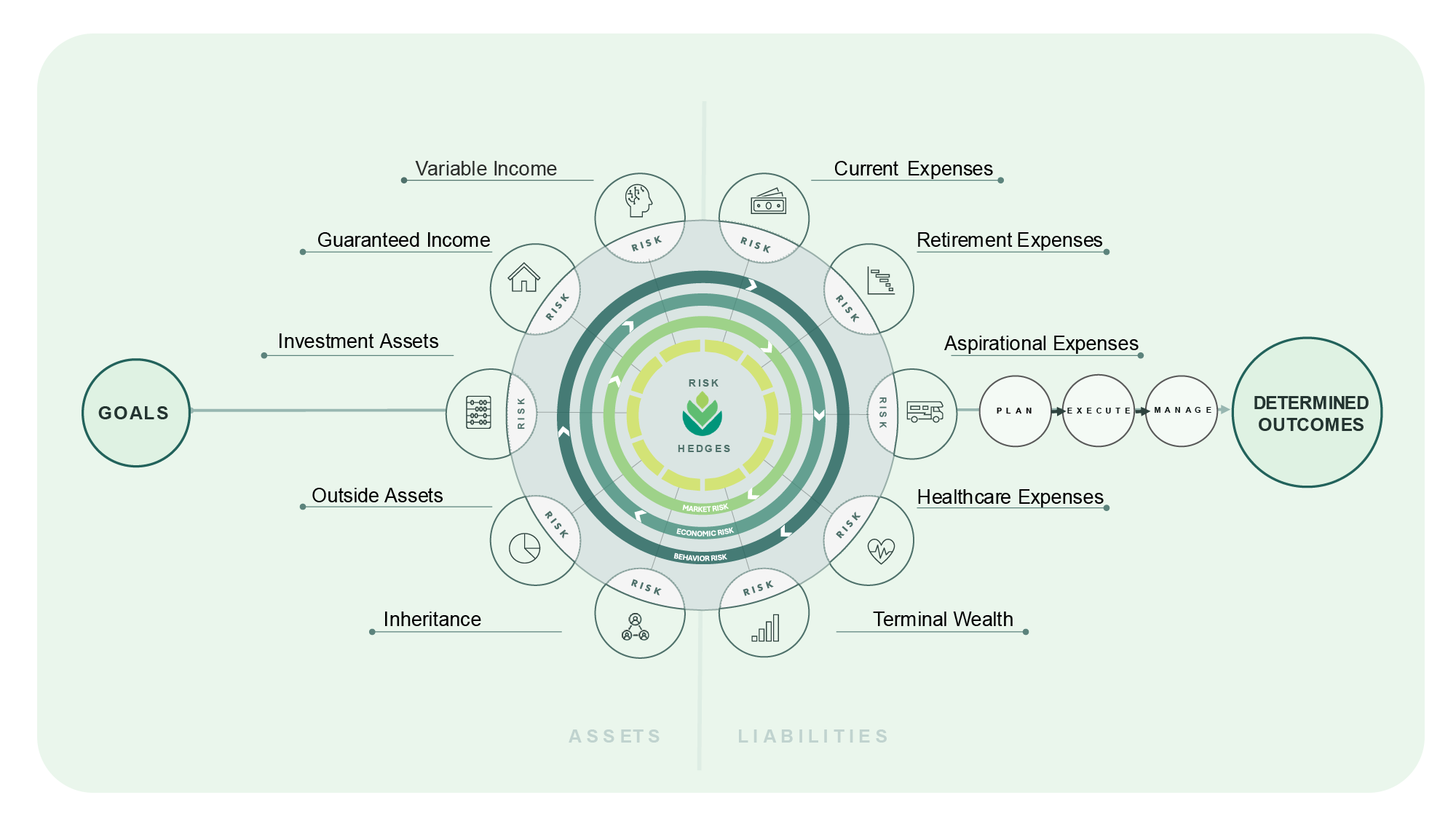

The Bonsai Philosophy democratizes an institutional-level approach by addressing uncertainty through a fully integrated personal asset liability management platform.

Asset Perspective - Includes all asset holdings that can fund current and future financial obligations with a focus on maximizing the "funded ratio".

Liability Perspective - Defined as the shortfall driven by the gap between projected income and expenses, including terminal wealth needs.